News release: LifeCraft Financial Planning Official Launch

June 10, 2021

How to read more

August 13, 2021

Not all financial advisors are paid based on a percentage and this makes comparisons among advisors challenging for the consumer. And underneath the “reasonable” part of the question is this: how do I know if what I am paying is worth it? Ultimately what makes a great investment experience is that you are making progress toward your goals. What you pay in fees both to your financial advisor as well as investment costs matters to that bottom line.

Traditionally financial advisors were compensated in one of two ways: they earned a commission on products they sold or traded, or they were paid a fee based on a percentage of the assets they managed. The main argument against the commission arrangement is conflict of interest. How can you know if a product or transaction is in your best interest when selling it to you is how your financial advisor gets paid? The percentage structure isn’t without its conflicts of interest—such as the encouragement to gather your assets under the financial advisor’s management, which in some instances might not be in your best interest—but it’s viewed as an improvement over the commission structure.

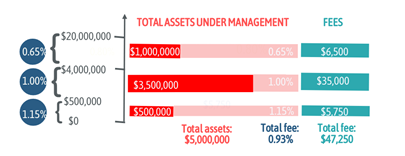

The method of paying for financial advice based on a percentage of assets the advisor is managing is called AUM for “Assets Under Management.” Often the percentage depends on how much you have invested. Using an example from NerdWallet’s review of the Zoe Financial platform, if you have $100,000 to $500,000, the range of fees charged is 0.8% – 1.5% per year (midpoint: 1.15%); $500,000 to $4 million is 0.7% – 1.3% per year (midpoint: 1.00%); $4 million to $20 million is 0.5% – 0.8% (midpoint: 0.65%). For purposes of this illustration, we’ll use the midpoint between the low-high ranges.

Like the way the tax brackets work, each asset level you fill up is charged at that rate and the result is you are charged a blended fee. The more money you have under the financial advisor’s management, the lower the percentage. Here is an example of how a blended fee is calculated:

This illustration calculates a blended percentage of 0.93% for a $5 million portfolio, which is about what NerdWallet says you can expect if you are paying AUM fees in the Zoe network. This gives us some context for talking about “reasonable percentage,” but we haven’t talked about what makes it worth it to pay these fees, which is making progress toward your goals.

A great investment experience requires you to counter the normal human emotions that get stirred up with the ups and downs of the stock market and the scary news on television with clarity and discipline. Vanguard does a study on the value added from working with a financial advisor and more than half of the 3% increase in net return they estimate comes from working with an advisor is due to their help in this area. Picking low-cost investment options, efficiently managing trading costs and optimizing for taxes contribute most of the remainder of the added value. So, in whatever way your advisor is compensated and however much you pay them, make sure you’re getting this added value.

As I said earlier, not all advisors are paid a percentage. The AUM compensation method is based on how much money you give the advisor to invest, which makes it look to me like investment management is the hamburger and financial advice is the fries. Our approach at LifeCraft Financial Planning is to look at the plate first and figure out what you want to eat. This approach is sometimes called holistic or comprehensive financial planning, with the emphasis on the financial advice.

So how does an advisor like me figure out what to charge for that, and for the consumer like you to know what’s a reasonable amount to pay?

We use a sliding scale based on your income, assets, and the complexity of your situation to determine the answer to that question. This approach is known as the flat fee method. According to NerdWallet, the range for this flat-fee approach is $1,200 – $10,000 per year, which in our sliding scale would be a suitable range for clients with income up to about $100,000, assets up to about $1 million and no more than a medium-level of complexity.

https://www.nerdwallet.com/reviews/investing/advisors/zoe-financial

Putting a value on your value: Quantifying Advisor’s Alpha (vanguard.com)

This does not constitute investment advice offered by LifeCraft Financial Planning, LLC and is not warranted to be accurate, complete or timely. Neither LifeCraft nor cited sources are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.